16 Nov Deductions

Deductions

Deductions are payroll items that will be deducted from an employee to arrive at the net pay. Common examples include pension/profit sharing contributions or the employees’ portion of health insurance premiums.

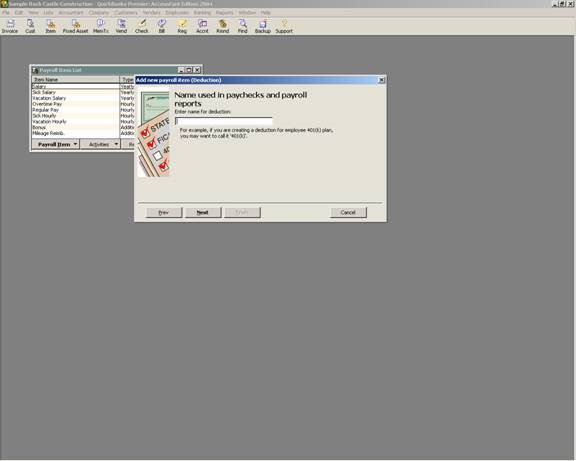

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next

The name should be something that makes sense for easy recognition on reports. It is also possible to track this expense by job when the check box is marked.

On the next screen, the name of the vendor to whom the check should be issued is chosen. It is also helpful to enter the number that the vendor has assigned to the business for printing in the memo field on the check so the payment is applied correctly by the vendor. By default, the liability account is payroll liabilities. It is still possible to generate reports on the item itself, but if seeing the balance due for this deduction is desired on the financial statement reports consider setting up a sub-account for tracking purposes.

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next > Name > Next

If the deduction will be reflected on tax forms, the next screen will provide the opportunity to designate how the contribution should be classified.

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next > Name > Next > Next

If the deduction should be deducted to gross wages prior to calculating any taxes, the next screen provides the ability to designate which ones.

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next > Name > Next > Next > Next

If the deduction is based on a quantity or hours, it is possible to designate it as such.

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next > Name > Next > Next > Next > Next

The next screen provides the ability to designate if the deduction should be calculated on the net pay or gross pay. While this may seem to have no great consequence since the previous screens already designated how the deduction will effect the calculation of the taxes, this is important from a reporting standpoint. The payroll summary report will place the deduction as appropriate based on the answer to this question, and the report may effect other calculation (for example if an add-on product is used for state payroll reports, this may effect the wage number used).

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next > Name > Next > Next > Next > Next > Next

If the deduction has a default amount or annual limit, this can be set up with the item. It is possible to enter it, or override the amount when adding the item to a specific employee. The purpose of this option is to improve data entry efficiency if the majority of employees will have the same amounts.

QBRA-2004: Lists > Payroll Item List > Payroll Item > New > Custom Set Up > Next > Deduction > Next > Name > Next > Next > Next > Next > Next > Next