17 Nov Customer Prepayment and Deposits

Posted at 00:16h

in

Customer Prepayments and Deposits

The most efficient way to record a customer deposit or pre-payment is:

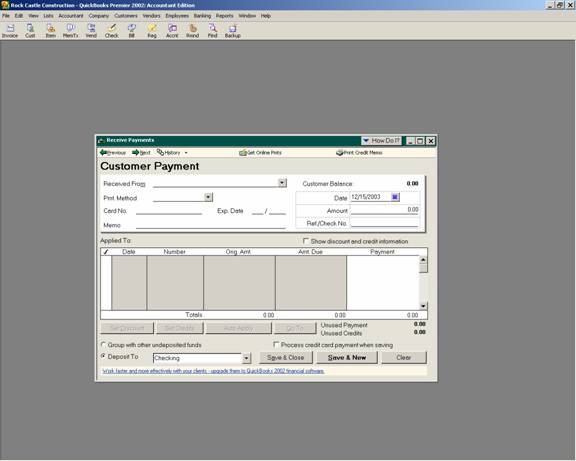

- 1. Receive payments as usual (Customers > Receive Payments). Because the invoice has not yet been created, the prepayment amount will remain unapplied. This will then show as a credit in Accounts Receivable for the customer.

- 2. Create the invoice for the entire amount of the job or project.

- 3. The invoice and the prepayment can be “linked” by choosing Customers > Receive Payments > Click on the box that says “Apply Existing Credits.” The software will then apply the previous payment (i.e. credit) to the outstanding invoice. This process can be done immediately with a zero in the amount column, or when the remaining balance is paid.

The advantage to using this approach is three fold:

-

-

-

- · Because the procedures follow the same steps as normal invoices and receive payments, it is easy;

- · The amount continues to appear on any Accounts Receivable reports, which makes it much easier for the small business owner to track; and

- · A statement generated for the customer would show the payments and invoices as they were created with the appropriate amounts and dates.

-

-

There are two problems with this approach:

-

-

-

- · Generally Accepted Accounting Principles (GAAP) states that the prepayment is not truly a reduction in the Accounts Receivable balance, but rather a liability to the company that it owes to the customer; and

- · In certain types of businesses, it is necessary to generate an invoice for the deposit amount from which the customer will pay.

-

-

QBRA-2003: Customers > Receive Payments

- To eliminate the two problems mentioned above, another alternative exists:

- 1. Create a new account for the tracking of the liability. Lists > Chart of Accounts > Account > New > Other Current Liability > Customer Deposits.

- 2. Create a new item for recording the customer deposits on an invoice. Lists > Items List > Item > New > Other Charge > Deposit > Description > amount can be left as zero > the item should not be taxable > the account code should be Customer Deposits as created in step 1 above.

- 3. Create an invoice for the deposit amount using the deposit item.

- 4. When the customer remits payment on the invoice, receive payment as usual.

- 5. Once the job is complete, create the final invoice. The invoice should be the full amount of the sale, with an additional line on the invoice for the deposit item. The deposit item is the amount that has already been invoiced as a negative amount. The result is an invoice with a total equal to the net amount now currently due.

- 6. When the final payment is received, choose Customers > Receive Payments as usual.

TRICK: When using the later approach, to ensure that the prepayment amounts balance, the Customer Deposits account can be reconciled by choosing Banking > Reconcile > Customer Deposits. The opening balance and the ending balance should both be zero.