16 Nov Credit Memos

Credit Memos

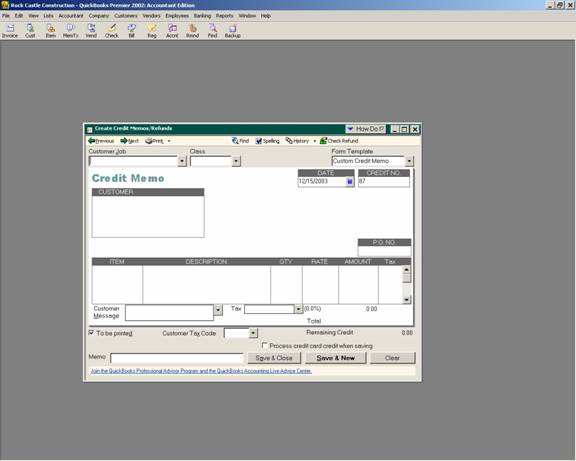

To create a credit memo, from the customer pull down menu choose “create credit memo/refund.” The credit memo form is filled out just like an invoice. All amounts and quantities can be entered as positive numbers. Because it is a credit memo the software knows that the amounts have a negative on Accounts Receivable and other related accounts.

QBRA-2003: Customers > Create Credit Memos/Refunds

Customer:Job – This field is completed by choosing from the customer:job list. This should be the same customer:job used when the original sale was made.

Class – If the class tracking preference is turned on, this box will appear. If it is turned off, it will not. It is also possible to customize the credit memo template to assign the class by line item in the body of the credit memo if that is more appropriate.

Template – There is a standard credit memo template. It is also possible to create a template to result in an credit memo that looks the way the business would prefer.

Date – This is the transaction date that will be used for updating the general ledger.

Credit No. – The Invoice form and Credit Memo form use the same numbering sequence. It is possible to manually enter any alpha-numeric credit memo number. However, using the sequentially generated number automatically entered by the software will help to eliminate duplicate entries and/or several transactions with the same number. One possible solution is to enter “CM” before or after the number to designate that it is a credit memo, and then remove the alpha characters from the invoice number when the next invoice is generated.

TRICK: The number is calculated by adding 1 to the number previously saved, not the next number based on the highest invoice number. For example, an invoice with number 405 was entered, then it was discovered 304 was missing. Number 304 is then entered. The next invoice number provided by the software will be 305, which will need to be manually changed to 406. This will correct the situation so the computer will be back on track to calculate the next sequential number.

Customer – These fields will be completed based on the bill to information entered onto the customer:job list. It is possible to change it when creating a credit memo. As the credit memo is saved, a message will appear asking if the change should be permanent (i.e. update the customer:job list information so it will appear the next time) or if the change is for this one time only.

Fields Row of information – The boxes that appear above the invoice detail can be customized based on specific business needs and preferences by modifying the template.

Columns – The columns, the order of the columns, the additional columns for progress invoicing, etc. can all be controlled by the invoice template). Depending on the type of business, for example, the service date column may be added; the class column may be added to the screen but not to the printed copy; etc. Typically the items used would be the same as when the original invoice was created. There are two exceptions:

1. Inventory – if inventory is returned and is salable, the original item may be used so that the quantity on hand will increase. If however, a credit memo is being issued for lost, damaged or defective goods, a new item should be created for that purpose using the general ledger account sales returns and allowances, or other account deemed appropriate by the business accountant. This will eliminate increasing inventory for goods that are physically available to be sold.

2. Bad debts – the amount invoiced, less sales tax should be entered as a bad debt taxable item so the software will calculate the amount of sales tax. This will eliminate the possibility of not receiving credit back for the sales tax already paid. A taxable code should also be considered for these types of transactions to make completion of the sales tax return more efficient. This item should be coded to bad debt expense.

Customer Message – These are default phrases that can be added to the bottom of the printed copy of the credit memo. There is not a way to have a customer message always appear without manually choosing it with each credit memo that is entered. A work around, however, is to use the long text section of the footer tab when customizing an credit memo template so the message is part of the template itself by default.

To be Printed or To be Emailed Check Boxes – By checking the appropriate box(es) it will be possible to process the printing or e-mailing of the credit memo as a batch, rather than individually.

Memo – The memo at the bottom of the invoice form screen will appear on reports and in the description section of the statement. It does not print as part of the credit memo.