17 Nov Consignor Accounting

Consignor Accounting

There are two issues that need to be considered when determining the best way to handle consignment inventory. One is the item type and the second is the reports that will be required.

Inventory vs. Non-inventory

The first issue is to determine if the items held on consignment will be set up as inventory or as non-inventory type parts. From a procedural standpoint, using non-inventory would be best as a general rule. The reason being, the amount should not be included in inventory since it is not owned. It should just “pass through” as the item is actually sold. To receive the item prior to the sale may create some logistical issues where as with the non-inventory method, the item can be sold, and then the bill or check created to remit the payment to the vendor who has placed the goods there on consignment.

Inventory in QuickBooks is based on average cost. If this is an acceptable method for the business, QuickBooks can work well when set up correctly and proper procedures are followed consistently for buying, selling and adjusting the inventory item balances. With that being said, when are inventory type items appropriate and when are non-inventory type items a better alternative?

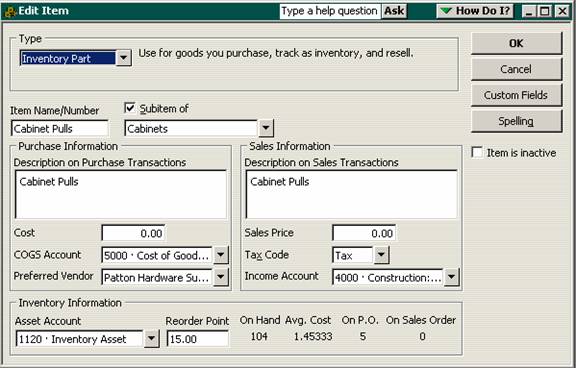

Let us start with the definition of inventory parts versus non-inventory parts. With inventory, the item is coded to an asset, a cost of goods sold, and an income type account. As the items are purchased (on the items tab of a bill, check, credit card charge, etc) the inventory balance is increased for the quantity and cost of the item on the balance sheet.

Non-inventory parts, however, only have one account and both the purchases and sales are recorded to the one account. To correct this coding error, it is possible to edit the item and check the box for “This item is purchased for and sold to a specific customer:job” in the middle of the item (Pro and higher only) to use the advanced job costing features. What the box says on the item is not important, what is important is that by checking the box the item now has “two sides.” One account is used for purchases and one will be for sales. With non-inventory type parts, the purchase is expensed and the sale is recorded as income. There is no matching of the timing between the two.

Items can be changed for coding corrections, or to change a non-inventory part to inventory. There is not any way to change the items from inventory to non-inventory (short of starting a new file or making the inventory items inactive). Make the corrections carefully, because it is possible that depending on what you do all the history could change as well.

The most important aspect of using inventory is always buy it before you sell it. And never ignore warning messages if it states that you do not have enough inventory to sell.

Report Alternatives

With the Pro or Premier products, there is a “Sales by Item Summary” report that will provide a gross margin calculation for inventory items only.

With the Premier: Accountant Edition or Premier: Manufacturing & Wholesaling Edition there is an industry specific report called “Profitability by Product” which will provide a gross margin for any type of item.

The other place that inventory vs. non-inventory comes into play will be for item “QuickReports.” The inventory items show the open purchase orders where the quantity is equal to the amount not yet received.

To include all inventory items only (note that this will not work for non-inventory type items) for the amount not yet “received” (i.e. sold) this QuickReport can be modified as follows then memorized:

1. Include all items

2. Transaction type should be Purchase Orders

3. Received should be No (this will remove all the purchase orders that have been received in full)

4. Posting Status should be Either (since Purchase Orders are non-posting)

5. Change the Header to a more appropriate title

6. Remove the Amount column (This is the extended amount of the purchase order in full, not just the quantity shown on the report, i.e. the quantity that has not yet been received. If an extended amount is needed, the easiest solution is to export the report to Excel and add the formula to compute the balance)

7. Memorize the report

To report on the value of the goods held on consignment is not an issue from an accounting standpoint since the consignment inventory is not owned by the business that is holding them. This may, however, be an issue for insurance, management purposes, etc. There is not a report which will provide the information exactly in the format desired in the Pro or Premier products (including the industry specific products). The QuickReport with modifications as detailed above may be a solution. Or there is a standard report called Open Purchase Orders by Job which will include all item types, not just inventory type items as with the QuickReport above. This report does require a job be assigned to each line of the Purchase Order. This report does show the item, as well as “ordered” and “received” but extended amount is based on ordered. Just like the QuickReport alternative, this report would need to be exported to Excel to calculate the value of the inventory being held. This report can also be more problematic than the QuickReport due to the “job” requirement on the Purchase Order.