17 Nov Confirm Tax ID Numbers

Posted at 12:56h

in

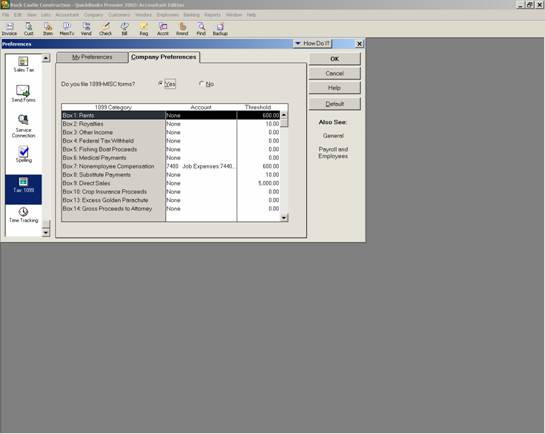

- Confirm Tax ID Number

- Edit each vendor from the vendor list that will require a 1099 and confirm the following:

- · It is often easiest to create a custom list report for reviewing the following issues. To do so, choose Reports > List > Vendor Phone List > Modify Report > Display Tab > add the columns for Tax ID and Eligible for 1099. While on the Modify Report screen, choose the Header/Footer Tab and change the Report Title to Form 1099 Vendors. Click on OK. Once you have made those changes, choose memorize, so that as you add or correct the information for the vendors, the report can be quickly re-created by choosing Reports > Memorized Reports to see which vendors still need to be updated.

- · There is a check mark in the box before “Vendor Eligible for 1099.”

- · There is a number in the “Tax ID” field. If the number is ###-##-####, make sure the name in the address field is an individual name with a DBA if necessary. If the number is ##-#######, make sure the name in the address field is a company name.

- · A complete address has been entered including zip code. (Note: The recipient”s name is the first name and last name from the vendor set up screen and then on the second line is the company name. For the street address, it is the line immediately preceding the city, state and zip line in the address section of the vendor set up screen (i.e. if the company name is the first line in the address section it is ignored). If the address section has a company name (which is ignored) and then two lines for the address prior to the city, state, and zip it is printed as one line on the form. Then the city, state and zip are printed in the appropriate box.)

- · To complete the paper trail, it is advised that each vendor eligible for a 1099 complete a W-9. This form can be obtained from the local IRS office, by calling 1-800-829-3676, or from their website at http://www.irs.ustreas.gov/prod/forms_pubs/forms.html.

- TIP: Start this process early and double-check it regularly throughout the year. It is much easier to obtain the information as new vendors are paid, then to go back and try to accumulate the information at the end of the year.

QBRA-2002: Reports > List > Vendor Phone List > Modify Report > Display Tab > add the columns for Tax ID and Eligible for 1099