17 Nov Comparative Financial Statements

Comparative Financial Statements

Utilizing comparative statements permits tracking how a business is progressing from one period to the next. Some examples of comparative periods could be year to year, or this quarter as compared to the same quarter last year, this month as compared to the year to date results. History is an important tool to see how changes that are made operationally in the business impact the financial statements. It is also a quick way to see if something is changing significantly to permit further investigation to determine how reasonable the outcome appears.

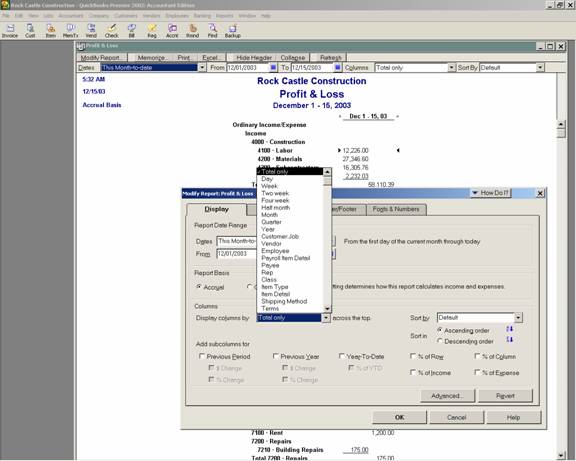

QBRA-2002: Reports > Company & Financial > Profit & Loss Standard > Modify Report

TRICK: If percentage of income columns are desired, it is best to start with the Profit & Loss Standard report so all columns will have the appropriate percentages. The Profit & Loss YTD Comparison report, for example, only displays one column of percentages when the % of income box is checked on the display tab.