16 Nov Company Information Overview

Company Information Overview

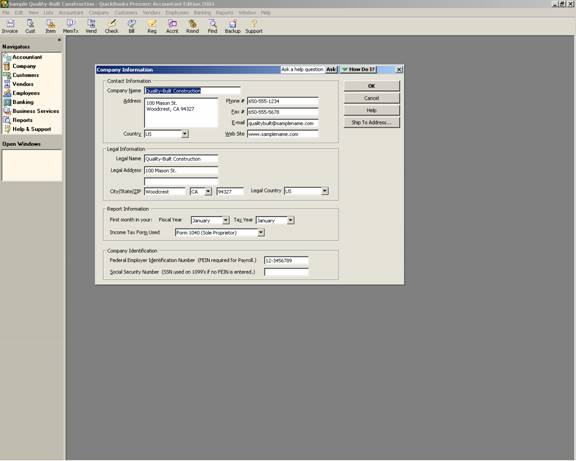

Basic company information is entered when creating the QuickBooks file. The Company information screen will permit editing that information or complete a more detailed review.

QBRA-2004: Company > Company Information

The Company Name is the name that will appear on reports, forms, etc. Often this is the same as the legal name, but it may be a DBA.

The Address is the address that will appear on forms. And again, this may be the legal address, or it may be different.

The Phone, Fax, E-mail and Web Site fields are very self-explanatory. This information can be added or removed from forms by editing the template (link to 149.100).

The Legal Name and Legal Address will be used on tax forms such as 1099s, W-2s, etc.

The first month in the fiscal year and tax year is important for reporting purposes. Choosing the correct month is sometimes confusing because standard accounting terminology is usually based on year end, not first month. For example, a 12/31 year end has a first month of January. This issue is further complicated for new business owners who will typically enter the month they started the business, rather than the first month in the fiscal or tax year. For example, a new business starts in April as a sole proprietorship. The first month in the fiscal and tax year is not April, but rather January since a sole proprietorship is a calendar year entity. In the first year, there is just no activity for the first three months.

The Company Identification will be the number supplied by the federal government (IRS or Social Security Administration) to the business or individual depending on the legal format of the entity. Sole proprietors, for example, may use a FEIN or the social security number of the owner, where as a corporation will only have a FEIN for the business.