15 Nov Classes Overview

Classes Overview

Classes are one of the most under-utilized and most powerful features QuickBooks has to offer.

Classes are the way QuickBooks tracks information to permit a detailed Profit and Loss based on various criteria. Basically it permits the Profit and Loss report to have a column for each class and then a total.

Common uses of the class feature are for departments, divisions, lines of business, different locations, profit centers, etc. A specific example would be a graphic designer who also offers print brokering services. The class feature will permit the owner to assess the profitability of each type of service resulting in information to make educated decisions on how to market, spend limited time, money, and other resources.

Some examples by industry might include:

Equipment Reseller Sales, Service, Overhead

Graphic Design Firm Desktop Publishing, Web Site Design, Print Broker, G & A

Accounting Firm Accounting, Tax, Resale, G & A

Retail Store Location #1, Location #2, Corporate

If the class field does not appear at the top of an invoice next to the customer name, or at the far right hand side of the expense or item tab of a check or bill, the preference has not been turned on.

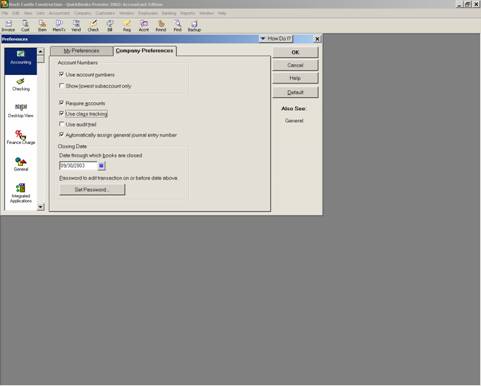

QBRA-2003: Edit > Preferences > Accounting > Company Preferences

QBRA-2003: Reports > Company & Financial > Profit & Loss by Class (assign several invoices to a class)

With version 2003 the class tracking alternatives have been expanded. A field is now present to assign the class for bank reconciliation activity and discounts plus there is a preference that can be used for prompting for a class on each transaction.

3/0/04