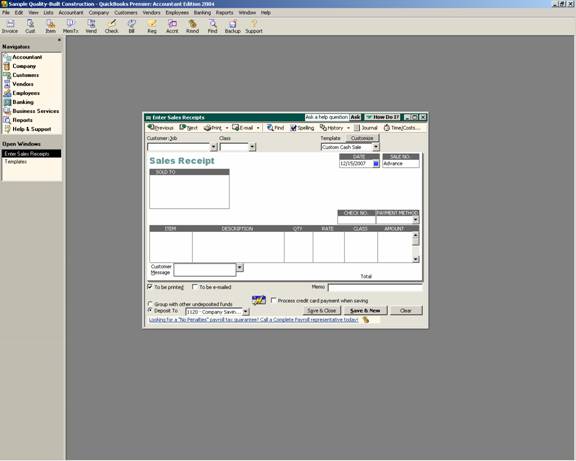

17 Nov Cash Sales Receipts

Cash Sales Receipts

Cash sales receipts are used for sales when the customer pays the amount due immediately. By using this form, the steps of invoicing and receiving payment are merged into one step.

QBRA-2004: Customers > Enter Sales Receipts

- Customer:Job – This field is completed by choosing from the customer:job list. It is also possible to set up a new customer:job by choosing that option from the pull down list.

- Class – If the class tracking preference is turned on, this box will appear. If it is turned off, it will not. It is also possible to customize the cash sales receipt template to assign the class by line item in the body of the cash sales receipt if that is more appropriate.

- Template – It is possible to create a template to result in an invoice that looks the way the business would prefer or to use the standard template provided with the software.

- Date – This is the transaction date that will be used for updating the general ledger.

- Sales No. – The numbers are automatically generated sequentially by the software. It is possible to manually enter any alpha-numeric invoice number. However, using the sequentially generated number automatically entered by the software will help to eliminate duplicate entries and/or several transactions with the same number.

- TRICK: The number is calculated by adding 1 to the number previously saved, not the next number based on the highest invoice number. For example, a cash sales receipt with number 405 was entered, then it was discovered 304 was missing. Number 304 is then entered. The next cash sales receipt number provided by the software will be 305, which will need to be manually changed to 406. This will correct the situation so the computer will be back on track to calculate the next sequential number.

- Sold To – These fields will be completed based on the information entered onto the customer:job list. It is possible to change it when creating a cash sales receipt. As the cash sales receipt is saved, a message will appear asking if the change should be permanent (i.e. update the customer:job list information so it will appear the next time) or if the change is for this one time only. It is also possible to modify the template to include a ship to address if applicable.

- Fields Row of information – The boxes that appear above the cash sales receipt detail can be customized based on specific business needs and preferences by modifying the template.

- Columns – The columns and the order of the columns can all be controlled by the sales receipt template. Depending on the type of business, for example, the service date column may be added; the class column may be added to the screen but not to the printed copy; etc.

- Customer Message – These are default phrases that can be added to the bottom of the printed copy of the cash sales receipt. There is not a way to have a customer message always appear without manually choosing it with each cash sales receipt that is entered. A work around, however, is to use the long text section of the footer tab when customizing the template so the message is part of the template itself by default.

- To be Printed or To be Emailed Check Boxes – By checking the appropriate box(es) it will be possible to process the printing or e-mailing of the sales receipts as a batch, rather than individually.

- Memo – The memo at the bottom of the invoice form screen will appear on reports. It does not print as part of the cash sales receipt.

TIP: This form is also extremely useful to record the totals for the day from a cash register receipt for retail operations.

TRICK: “Undeposited funds” is a special QuickBooks account used for accumulating payments from various customers. The advantage is that by using undeposited funds then creating one deposit into the bank account, the register will more closely match the bank statement. Think of undeposited funds as your top desk drawer: You enter the receipt into the computer and put the money into the drawer. Once you have entered them all, you scoop them up and take the money to the bank to make the deposit.

TIP: To use the “process credit card payment when saving” feature requires signing up for the QuickBooks Merchant Account Service.