17 Nov CA Payroll Tax Preparers

CA Payroll Tax Preparers

Some of you have been using the “Summarize Payroll Data in Excel” to file the DE-6. We have been hearing that the EDD had not rejected the information submitted in that way. However, in the Second Quarter 2005 edition of the California Employer Newsletter these alternative forms require previous approval.

We handle the issue by signing up for the Enhanced Payroll Plus Service from Intuit, new with version 2005.

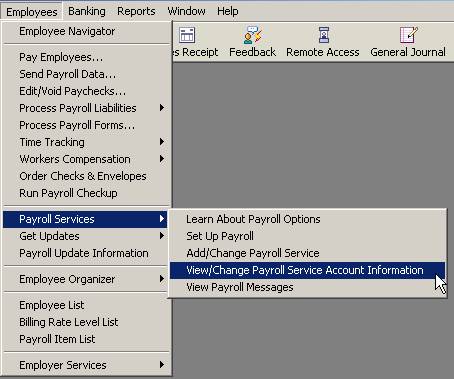

The way our process works is that we receive the back up from the client and complete the rest of our work on whatever version of QuickBooks they have. We back up the file to return to them and then we convert the file to version 2005 (unless they already are using 2005). At that point, we go to Employees > Payroll Services > Add/Change Service. Obtain the key code for the client’s tax id number (800-624-2106 Monday – Friday 8 am – 5 pm Pacific Time) and enter it. Keep a record of the key code so you can enter it for the next processing.

Using 0″>Enhanced Payroll Plus for Accountants you are able to process payroll for up to 50 clients with a single subscription. Note: The additional EINs must be processed from within the same licensed copy of the QuickBooks software. I.e. the Accountant must prepare the payroll processing in their office with their copy of the QuickBooks software.

We thought we were fine until we discovered an FAQ that states to complete state payroll forms the client must subscribe to the Enhanced Service as well.

The information reads:

|

Accountant or Bookkeeper Use Only: |

Most clients just have the Standard Service so they can calculate net checks and then use us, the Accountants, to perform the additional services. This concerned me so I did some checking around and below is the information I received from Jeremy Rosenberg at Intuit:

|

Updates to Enhanced Payroll Plus for Accountants Accountants spoke, and we listened. A recent change will allow accountants who are subscribed to the Enhanced Payroll Plus for Accountants service to use their subscription to prepare state forms for their clients who are subscribed to only QuickBooks Standard Payroll. This means that accountants can now use their Enhanced Payroll Plus for Accountants subscription to offer payroll services to clients for whom they provide end-to-end payroll services as well as those clients for whom they provide only quarterly federal and state filing services, no matter what level of subscription the client is on (Standard or Enhanced). With this update, Enhanced Payroll Plus now works the way accountants told us they want to work with their clients. Here”s how it works:

Note: Your client must also be using QuickBooks 2005 because the State Forms feature is not available in previous versions of the software. Both your payroll subscription and your client”s must be current and up to date, and both of you will need to have downloaded a payroll update in the past 45 days, in order to validate that your subscription is current. Remember: Your client needs to have their own QuickBooks Payroll subscription only if they are handling some of the payroll processing tasks themselves, such as entering hours and printing paychecks. If you handle the entire payroll process on behalf of your client, then you can simply add them to your Enhanced Payroll Plus for Accountants subscription, which can be used for as many as 50 companies, and you can save your client the cost of purchasing their own subscription. |