18 Nov Batch Reports

Batch Reports

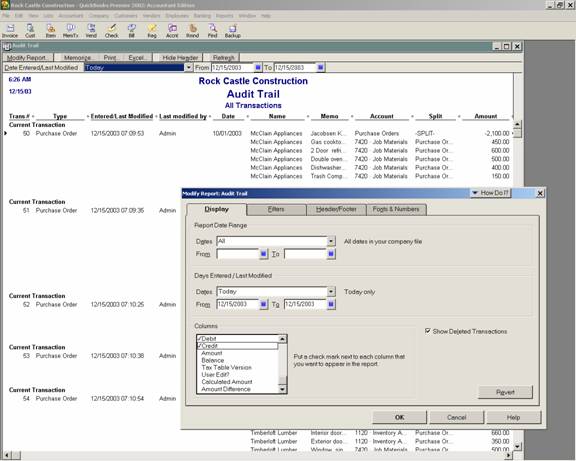

To conform to typical accounting reports, it is often desired to change the amount column (shows as positive and negative numbers) to debit and credit columns. To achieve this result, it is necessary to customize the report in the older versions. This was changed with version 2003 for the Premier: Accountant Edition to be the default.

QBRA-2002: Reports > Accountant & Taxes > Audit Trail > Modify Report > Display Tab > Uncheck amount column, place a check mark next to Debit and Credit

Batch reports can be created from the Journal Report or the audit trail report if the current and previous entries are the expected result. This report, with the modification of debit and credit as mentioned above, presents the journal entries for each transaction. It does not, however, have a report total by general ledger account.

For a report that resembles a more traditional batch report with a total by general ledger account, the Transaction Detail by Account report may be preferred. This report can also be customized to include the debit and credit columns rather than the amount column. It can also be filtered to include only specific transaction types, such as journal entries or bills or specific accounts like taxes or legal, etc. The advantage is the subtotal for the transactions that affect each account. The report total at the bottom will net to zero.

QBRA-2002: Reports > Accountant & Taxes > Transaction Detail by Account

TIP: This same Transaction Detail by Account report can be filtered for specific accounts to create subsidiary ledger reports for a specific date range.