17 Nov Ask the Expert – Retainer Transfer

Ask the Expert – Retainer Transfer

Q – After setting up, receiving and invoicing a retainer, I wanted to write the check from the retainer checking account and deposit it in a main checking account but was not able to deposit in “undeposited funds” with other checks. Is there a better way to handle this? They are in different banks so a simple transfer didn”t appear to be the option either. Submitted by Lucinda

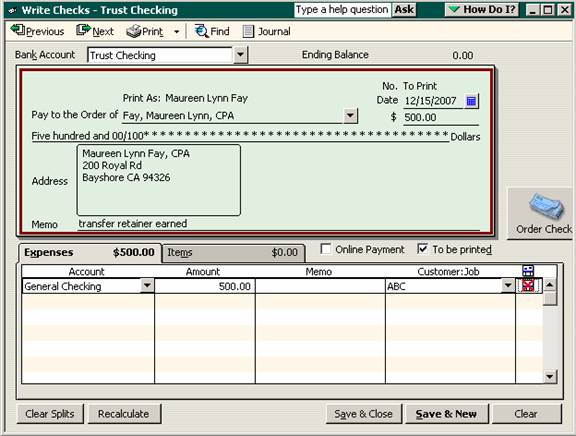

A – I agree, if you need to do an actual check, the transfer is not going to be the best alternative. I am assuming you are dealing with the reduction in the retainer liability account when you have invoiced the client for the actual work performed. The part of the transaction we will deal with here is just issuing the check to transfer the money from the trust checking (to keep it in balance with the trust liability account) to the general checking since the money has now been earned.

The easiest way to accomplish this is to write the check from the trust checking account and for the account on the expense tab is to enter the general checking account. This will decrease the trust account and increase the general checking in one step. Keep in mind that this assumes that you will be depositing the retainer amount directly (i.e. not including it in a deposit with any other amounts).