16 Nov Ask the Expert – Flat Fee Invoice for Unbilled Costs by Job

Ask the Expert – Flat Fee Invoice for Unbilled Costs by Job

Q – I have a client that tracks costs for their jobs. But they don”t invoice the costs to their clients, just a fixed fee. I am trying to use the unbilled costs report to track the work in process. Can I have the costs billed on the clients invoice without changing the invoice that the final client sees? Submitted by Lee

A – My first thought is that it might be easier to use the Job Profitability Summary to see how each job is doing. This would permit marking the costs as assigned to a specific job, but by clicking on the billable icon, it will have a red “X” on it. This means that the amount should be included on job profitability reports, but will not be used to create invoices.

If there is a reason that you prefer the Unbilled Costs by Job Report the alternative is to use the time/cost button and hide the activity that should no longer appear on the report on when invoicing.

TRICK: If the items are marked as hide, clicking OK at the bottom of the time/cost button saves the change (i.e. the costs will no longer be available to invoice) even if the invoice is not recorded.

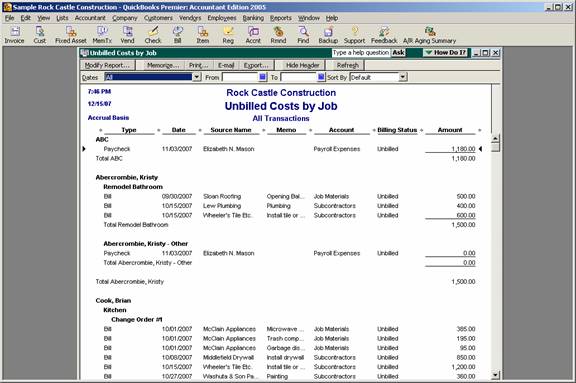

QBRA-2005: Reports > Customers & Receivables > Unbilled Costs by Job

QBRA-2005: Customers > Create Invoice > Choose Customer > Time/Costs > Click in Hide column

QBRA-2005: Customers > Create Invoice > Choose Customer > Time/Costs > Click in Hide column > OK > Save & Close invoice

QBRA-2005: Reports > Customers & Receivables > Unbilled Costs by Job

If you go back and look at the original bill, it will now show the line item with the red “X” (i.e. non-billable) by marking it as hide when invoicing.

QBRA-2005: Find > enter criteria > double click on bill