17 Nov Ask the Expert – Commission Based on Receipts

Ask the Expert – Commission Based on Receipts

Q – Our company has been paying commissions on monthly sales, but is moving to a commissions paid on monies collected (invoices paid) system. Each invoice in QuickBooks has a salesperson assigned to it. I have been unable to get a report from QuickBooks that shows me monies collected on paid invoices by sales rep. Do you know how I can get this information? We are using Pro 2005. (Submitted by Lisa)

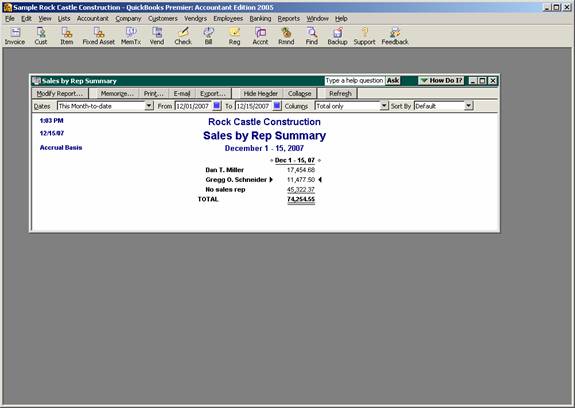

A – The first issue that will be a little challenging is the logistics of the transition. It would be quite easy to inadvertently pay commissions under the old system (based on the accrual basis reports using invoice date) and then pay the commissions again using the new system (based on the cash basis reports using invoice paid date). Depending on the dollar amount and other management implications, it may be easiest as of the conversion date to see what invoices have had commissions paid on them already, and either back those out of the next commission payment, or those invoices will need to be addressed with each subsequent commission payment until all of the previous invoices has been paid by the customer. The example below shows the dramatic difference this change from accrual (sales for DTM of $17,454.68) to cash (sales for DTM of $1,930.50) can make in the basis for the commission calculation.

QBRA-2005: Reports > Sales by Rep Summary (Accrual Basis)

QBRA-2005: Reports > Sales by Rep Summary (Cash Basis)

When drilling down on the cash basis reports the transaction date is the date paid, to see the invoice date requires double clicking on the transaction. In an example below, the payment was received 12/15/07 (as is shown on the report) and the actual invoice date was 12/01/07. Because the report is created on the cash basis (i.e. when paid not invoiced) the difference is apparent.

QBRA-2005: Reports > Sales Summary by Rep > Modify Report > Cash Basis > OK > Double click on the dollars for a specific Rep

QBRA-2005: Reports > Sales Summary by Rep > Modify Report > Cash Basis > OK > Double click on the dollars for a specific Rep > Double click on the invoice

By using this report, the change for paying commissions on the accrual (invoice date) basis to the cash (invoice paid) basis can be easily accomplished.