17 Nov After the Fact Payroll

Using QuickBooks for “After the Fact” Payroll

To use QuickBooks for after the fact payroll, the set up and processing using the Do It Yourself Payroll Service. For accountants processing payroll for multiple clients, a call to Intuit with the tax identification number of the client will permit using the Do It Yourself subscription for multiple QuickBooks company files.

For after the fact payroll, (the bookkeeper or accountant will prepare the payroll tax forms while the client calculates the net checks each payroll), it is necessary to enter all the information through the normal payroll features. For many clients, this means that in the extra time it takes for the bookkeeper to “balance” to the checks that have been manually created, it would have been faster (and less costly) to just let the bookkeeper do the paycheck calculations from the beginning.

For those clients who use a payroll service: Based on the market share QuickBooks enjoys, many of the payroll processing companies do offer an iif file that will import the payroll detail directly into QuickBooks to eliminate the data entry. This is often time consuming to set up, but well worth the investment long term based on increased efficiency and reduced data entry errors.

If an outside service is being used for processing payroll, a decision will need to be made regarding the level of detail needed in QuickBooks. Discuss the issue with the service currently being used since many now offer a QuickBooks interface based on small business customer demands. Paychex and Complete Payroll do and ADP does for some of their products with more to be available by the end of 2003.

TIP: Complete Payroll (previously Computing Resources Inc (CRI) which Intuit purchased in 1999) offered through Intuit is now available as an alternative to other outside services. Because the import is coming directly from Intuit into QuickBooks the interface should be less troublesome.

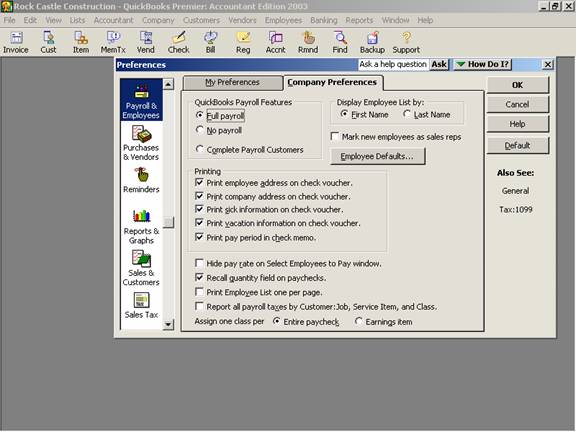

Confirm that the preferences have been set properly. Complete Payroll Customers are those businesses who use Intuit’s payroll service and wish to import the information into QuickBooks.

QBRA-2003: Edit > Preferences > Payroll & Employees > Company Preferences