16 Nov Adjusting Journal Entries

Adjusting Journal Entries

Managing journal entries input by the accountant has always been important. There have been work arounds in the past, but with version 2004 Intuit has addressed this issue in an effective way.

General journal entries have long been the accountant’s “domain.” Although many of the adjustments that need to be made are handled more effectively by using a QuickBooks form, there are certain instances when creating a journal entry is the only way to enter the transaction. This includes Accountants who are using the Accountant’s Review Copy with their clients. Assuming entering the transaction as a journal entry does not have any reporting or feature implications (for example if inventory or payroll features are being used); the new adjusting journal entry feature expands the reporting capability for work paper preparation for the accountant.

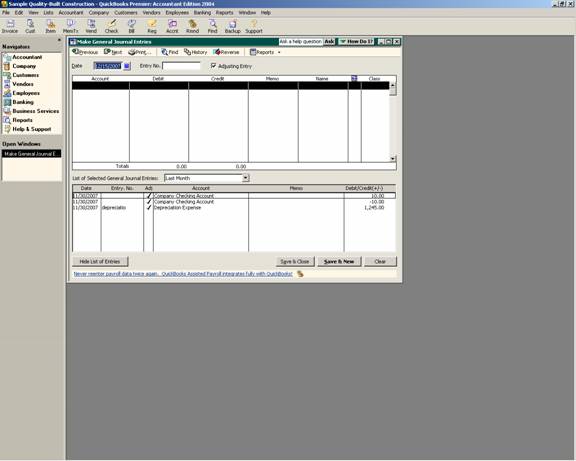

QBRA-2004: Company > Make General Journal Entries

TIP: The ability to set a preference to have the software automatically, sequentially number the journal entries was new with version 2002. New with version 2003 was the ability to see a specific date range of journal entries on the screen below the journal entry input screen.

The new addition for QuickBooks Premier –Accountant Edition version 2004 is the ability to mark a journal entry as an adjusting entry by clicking on the check box. This small change has large implications to increase the flexibility of reports. For example, the adjusting column (a check mark in this column designates the entry was an adjusting entry) has been added to the default format for the following reports:

- General Ledger

- Journal Reports

- Profit & Loss Detail

- Balance Sheet Detail

- Transaction Detail by Account

- Transaction List by Date

- Audit Trail

- Income Tax Detail

TRICK: The ability to filter a report for only the adjusting journal entries is not available.

With Version 2003, there are also two new reports designed specifically to streamline the process for accountants: the adjusted trial balance that includes the unadjusted balance, adjustments, and adjusted balance columns; and the adjusting journal entries report which is a report of only the entries for the time period that have been designated as adjusting journal entries.

New with version 2005 is the ability to have the adjusting entries appear on a working trial balance report.