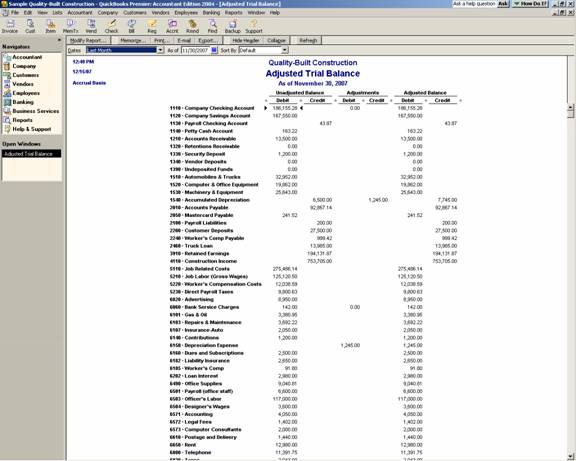

18 Nov Adjusted Trial Balance

Adjusted Trial Balance (2004 or later)

Ask the Expert…

Q – In my firm we prefer the unadjusted, adjustments, adjusted type of format for the trial balance. Is there a way to do that when using QuickBooks?

A – The answer will depend on what version of QuickBooks you are using.

New for QuickBooks 2004: Accountant Edition: When entering a journal entry it is now possible to mark a check box that designates the transaction as an adjusting entry. This feature is extremely helpful for Accountants who are performing period end or reclassification entries and have the need to create specific reports documenting the work that they have done. The power of this option is that now additional filter options available, as well as two new standard reports to aid in documenting the adjustments that have been made to the QuickBooks file by the accountant. These reports are useful for the accountant work papers. In addition, it is now easy to print these two new reports (an Adjusted Trial Balance report and an Adjusting Journal Entries Report) for the client to ensure that the adjustments are entered back into their file if the back up or Accountants Review Copy type files are not returned to them.

TRICK: Be careful of the date range at the top of the report. The adjusting entries will be included in the adjustments column only for the last calendar day of the report date range. So, when entering the adjusting journal entries, be sure to only use the last day of the period being adjusted for the adjusted trial balance report to appear as expected.

QBRA-2004: Reports > Accountant & Taxes > Adjusted Trial Balance

Prior to version 2004: There was not a standard adjusted trial balance report available within the system that shows the unadjusted figures, entries made, and ending adjusted balance.