17 Nov 1099 Reports Overview

1099 Reports Overview

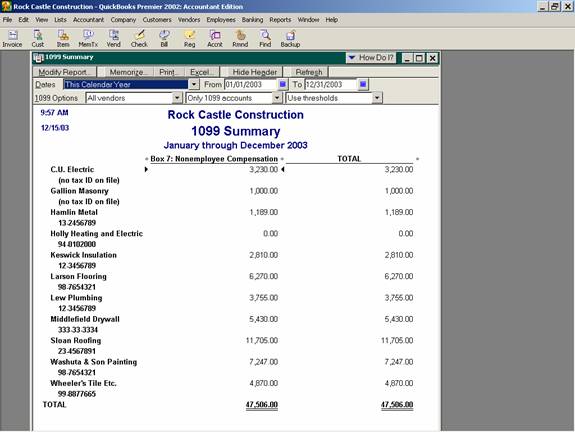

The 1099-MISC forms are based on a cash basis, i.e. the amount paid will be reported when the check is actually issued as opposed to when it was incurred or due. These forms are due annually, and are typically prepared in January of the subsequent year. For that reason, the default date is set for the last calendar year. As with all reports, the date can be changed. To create a report to show the individual payments included for review prior to printing the 1099-MISC forms, choose Reports > Vendors & Payables > 1099 detail. It is recommended that you retain this report for supporting purposes for the printed forms. To see the totals only, choose Reports > Vendors & Payables > 1099 Summary. To be sure no one has been missed change the choice at the top of the report to include all vendors

.QBRA-2002: Reports > Vendors & Payables > 1099 Summary