18 Nov Consolidation Procedures

Consolidation Procedures

Within the QuickBooks accounting software, there is not an option for consolidation of multiple data files. For consolidation of multiple data files, the most efficient solution is that they be handled through journal entries following the rules detailed previously. As an alternative, if several company files exist and there are relatively few consolidation entries to be made, the most efficient solution may be to create the financial reports in QuickBooks, then choose the Excel button. Instead of choosing to create a new file, open all of the reports in the same file to permit easier manipulation. A new sheet in the file can then be created to accumulate the balances as needed from the supplemental sheets.

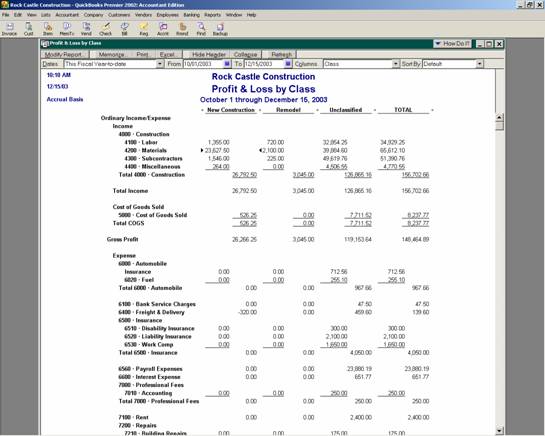

If the consolidation requirements do not result in the need for separate data files, data entry using the class function often proves to be a solution for Profit & Loss reports. The term used by QuickBooks for accounting for segment, divisions, or profit centers is “classes.” Using this feature will permit generating a Profit & Loss by Class report. Other customized reports can also be created using this feature. For the Profit & Loss accounts no additional accounts are needed. First turn on the preference (Edit > Preferences > Accounting > Company Preference) Then for each account the class information is captured in a separate field as the transactions are entered. The result is a short chart of accounts list while adding the increased options for reporting.

QBRA-2002: Reports > Company & Financial > Profit & Loss by Class

For a Balance Sheet by class, however, individual accounts should be created for each account by class. To create meaningful reports with subtotals by class cannot be done within QuickBooks itself. The best alternative is to create the Balance Sheet in QuickBooks (expanded for all the detail by sub-account, i.e. accounts by class) then use the Excel button at the top of the report to pull the information into Excel. Once in Excel, the modifications can be made to conform to the desired presentation.