17 Nov Inventory Valuation Summary

Inventory Valuation Summary

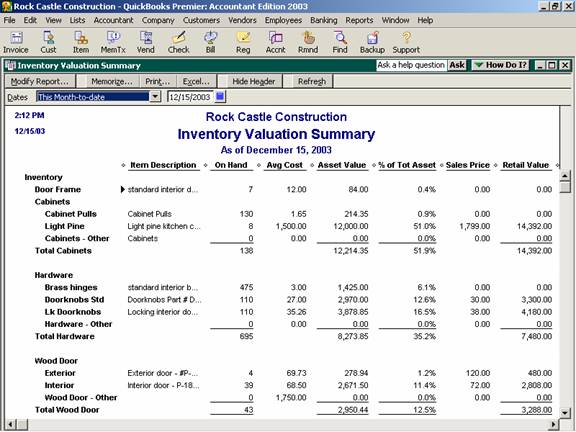

Once any necessary adjustments have been made, the inventory valuation report will provide the quantity and average cost for each item to support the balance on the financial statements. The average cost column is based on the purchases, sales and adjustments made to an item. The retail column, however, is based on the sales price entered with the item. It does not necessarily correspond to the actual price that the item has been sold for. Because of this, it is recommended that the retail columns be removed using the same process as described above to remove the quantity column from the physical inventory worksheet.

QBRA-2003: Reports > Inventory > Inventory Valuation Summary

To show the detail of the transactions related to a specific item, place the cursor over the dollar amount and it will change into a magnifying glass. At that point, double click with the mouse button and the software will “zoom” in on a detailed listing of the transactions. To see the actual transaction, double click on that line from the report, and the software will “zoom” in on the form where the data entry was completed.

TRICK: If the detail does not match the financial statements, the reason is usually the result of one of the following:

1. A transaction was coded directly to the inventory balance on the general ledger, rather than following proper procedures through the enter bills, write checks, create cash sales receipt, create invoice, or inventory valuation process. Typically, this error will be the result of a journal entry, or a purchase on a bill or check coded to inventory on the expense tab, rather than through purchasing an item on the items tab. Although it is not recommended, if an adjustment needs to be made in total, rather than item-by-item, use the procedures in the next section to create an item specifically for the inventory adjustment so it will appear on the reports. This process will eliminate the problem of running balance differences between the detail reports and the financial statements that a straight journal entry will create.

2. An inventory item that still has a value has been marked as inactive.