17 Nov Ask the Expert – Petty Cash by Employee

Ask the Expert – Petty Cash by Employee

Q – We handle petty cash a little differently than in your previous article. Our employees receive a petty cash “advance.” Receipts are submitted sporadically. Additional advances are provided in even dollar amounts. How is the best way to handle this? Submitted by Dianna

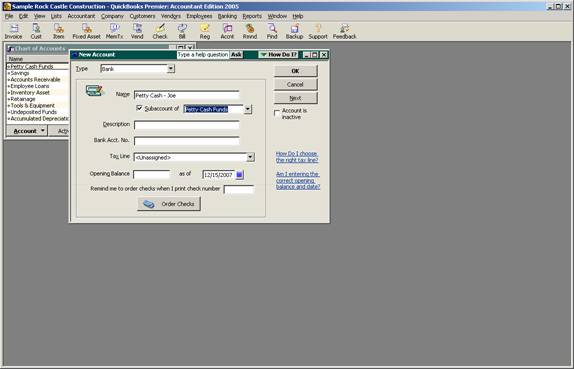

A – My suggestion in this case is to create a petty cash bank account for each employee that receives a “petty cash” advance.

QBRA-2005: Lists > Chart of Accounts > Account > New

This account will be used when the check is written to the employee. The change from a typical petty cash fund in your case is that this account will be used each time a check is issued.

QBRA-2005: Banking > Write Checks

As receipts are received they will be entered into the register as a “check” without a check number. These receipts will reduce the amount of petty cash the employee has.

QBRA-2005: Lists > Chart of Accounts > double click on Petty Cash – Joe

This process will provide a detailed accounting of the money given to the employee and how it was spent. It will also make it easy to see if receipts are not being received for a reasonable amount prior to another “advance” check.

If the employee’s relationship with the business should terminate, it is also easy to see the amount the employee needs to provide in receipts or cash.