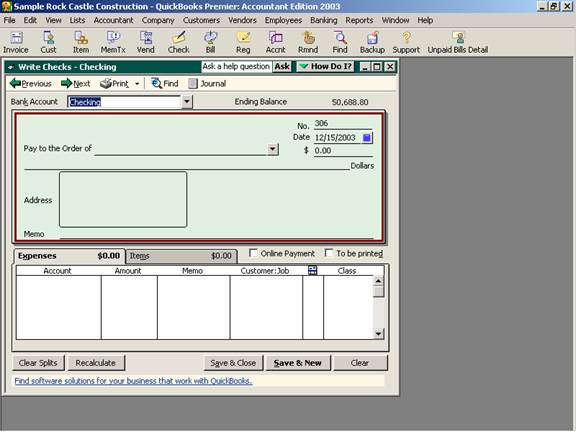

17 Nov Write Checks

Writing Checks

This function can be used for expenditures paid when incurred (no need to record a bill and bill payment through Accounts Payable procedures for accrual purposes) or when the bookkeeping records are kept on a cash basis.

For some individuals performing data entry functions, this method is easier than the register since a check “looks like a check.” This method is also preferred if many of the transactions will require a “split” among several general ledger accounts for each transaction, of it customer:job procedures or class tracking options are being used.

QBRA-2003: Banking > Write Checks

TRICK: Expenditures entered directly as checks will not appear on Accounts Payable reports.

TIP: This function can also be used to record check printing charges, ATM withdrawals, and automatic withdrawals from the bank account (i.e. loan payments, insurance premiums, etc.) just like transactions recorded directly into the register. The check number can be deleted or alphanumeric characters can be entered in this field.

TIP: If using bills and bill payments, be sure to follow the correct procedures. If a bill is entered and then a check is entered, the result is that both transactions could be coded to the same general ledger account.