17 Nov Paying Payroll Liabilities

Posted at 02:50h

in

Paying Payroll Liabilities

Payroll taxes are accumulated as employees are paid through the normal payroll processing procedures. To generate a tax payment, always choose the pay payroll liabilities. Never do a journal entry or code a transaction directly to the liability or the detail reports will no longer match the general ledger. All payroll transactions are recorded as of the paycheck date. There is not an automatic accrual based on the period end date. If any payroll expense is to be accrued it should be recorded manually and then reversed.

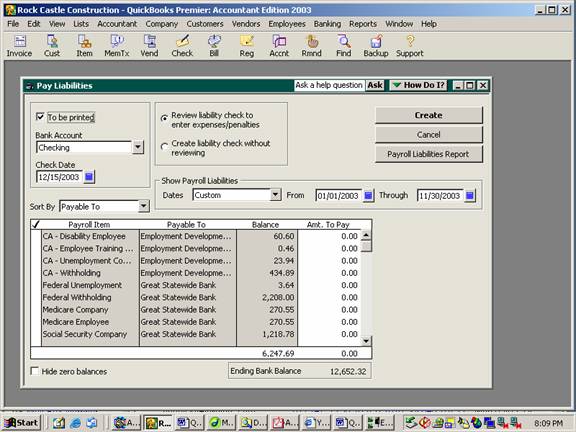

QBRA-2003: Employees > Pay Payroll Liabilities